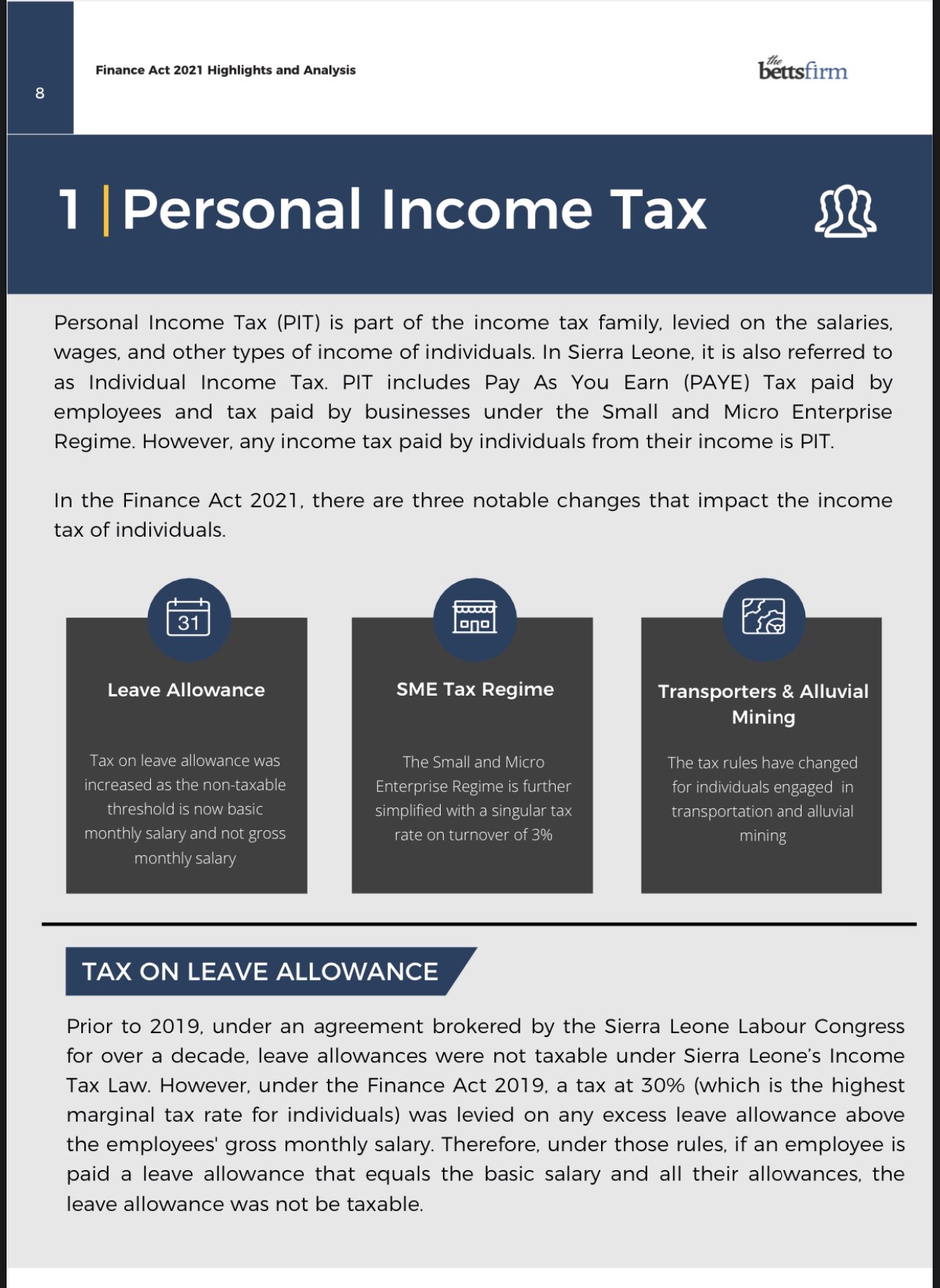

Good News – Microenterprise Tax Credit Increased/Extended | Omaha CPA | Quickbooks Support | Tax Prep | Bookkeeping

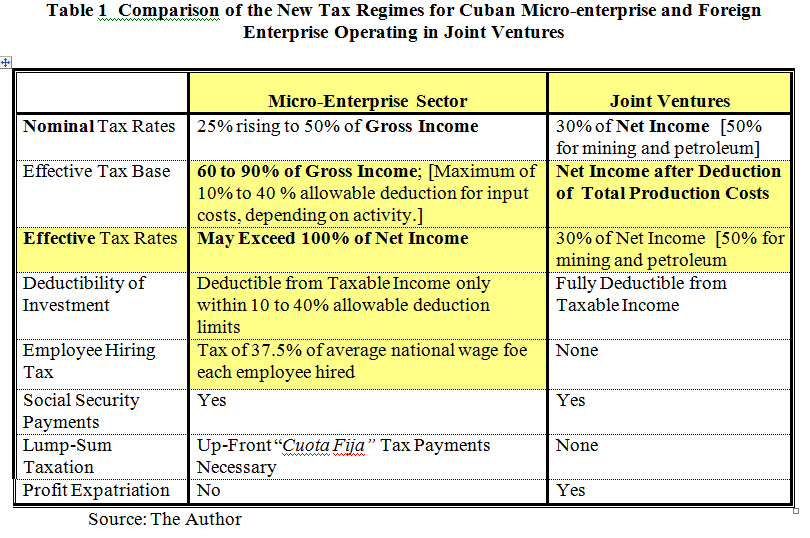

![PDF] Tax incentives for small and medium-sized enterprises - a misguided policy approach? | Semantic Scholar PDF] Tax incentives for small and medium-sized enterprises - a misguided policy approach? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7942be93210be8ac14c66ada07084698f834c8c8/87-Table14-1.png)

PDF] Tax incentives for small and medium-sized enterprises - a misguided policy approach? | Semantic Scholar

Micro-enterprise Tax Reform, 2010: The Right Direction but Still Onerous and StultifyingThe Cuban Economy – La Economía Cubana